Vancouver, B.C. – April 6, 2022 – Kainantu Resources Ltd. (“KRL” or the “Company”) (TSX-V: KRL, FSE: 6J0) is pleased to announce that it has entered into a definitive agreement with Harmony Gold (PNG) Exploration Limited (“HGEL”), a wholly-owned subsidiary of Harmony Gold Mining Company Limited (“Harmony”) to acquire 100% ownership of the Kili Teke Gold-Copper Project (“Kili Teke” or the “Project”) in Papua New Guinea (“PNG”) (the “Acquisition” or “Transaction”) .

Kili Teke is a significant advanced exploration porphyry gold-copper project with an existing mineral resource, and potential for further re-optimization and discoveries to increase overall value.

Highlights:

- KRL to acquire 100% of the Kili Teke project from HGEL:

- advanced exploration Au-Cu project in premier region of PNG;

- has an existing defined Inferred Mineral Resource of 237Mt @ 0.34% Cu (=0.8Mt Cu), 0.24g/t Au (=1.8Moz Au) and 168ppm Mo (=0.04Mt Mo), with an effective date of 30 June 2021;

- over 36,000m of drilling completed to date;

- significant exploration resource upside, with near surface, high-grade Au skarn mineralisation not yet included in the defined Mineral Resource;

- potential for re-optimisation, bringing Kili Teke significantly closer to production as an open-pit mine to increase economic returns;

- Terms of Agreement:

- initial cash consideration of US$1 million, payable in two instalments: US$500,000 on closing (targeted for May 31, 2022); and US$500,000 on receipt of post-closing regulatory approvals (expected in late 2022 or early 2023);

- KRL intends to work towards a Preliminary Economic Assessment (“PEA”), then a Feasibility Study. If KRL views the Project positively at each step, KRL to make further payments to HGEL of US$3 million and US$4 million respectively;

- KRL to pay HGEL a 1.5% net smelter royalty from future mine revenue;

- potential for Harmony to become a strategic investor in KRL under the Transaction, with HGEL to be issued warrants equal to 9.9% of the issued share capital of KRL on closing (with each warrant exercisable at C$0.28 per share or a 25% premium to the KRL 30-day VWAP to April 5, 2022).

Matthew Salthouse, CEO of KRL, commented:

“We are delighted to announce the acquisition of Kili Teke which aligns with our strategy of building shareholder returns by executing value accretive acquisitions. In this regard, our extensive due diligence indicates Kili Teke will be a transformative and accretive acquisition for KRL and will elevate our asset portfolio, adding an established gold copper resource which has potential for significant growth.”

“The Project lies on the highly prospective Papuan Fold Belt which hosts world class projects, such as Ok Tedi, Frieda River and Porgera. We look forward to exploring and developing another potential world class project for the region.”

“This transaction moves KRL from a greenfield high potential explorer into being a resource development company with upside. For a junior to achieve this after a year of listing is a testament to the team’s vision on growing KRL via accretive transactions in combination with on-going field work.

HGEL has already made excellent progress to date in developing the Project, delineating an impressive copper gold resource of 800Kt copper and 1.8Moz gold; with the deposit remaining open to the southeast and down depth. Through the grant of warrants to acquire equity in KRL of up to 9.9%, HGEL has an option to engage further.”

“KRL will continue to deliver on our strategic objectives with Kili Teke a key catalyst in driving shareholder value as we develop as an Asia Pacific gold-copper mining company.”

Johannes van Heerden, CEO for Harmony South East Asia and senior executive for New Business at Harmony Gold Mining Company Limited commented:

“Harmony remains focused on permitting and delivering the much anticipated Wafi-Golpu project alongside its existing Hidden Valley mine life extension project. In addition to these on-going projects, Harmony has identified additional potential growth opportunities in and around the Hidden Valley mine. These multiple workstreams demonstrate our long-term commitment to Papua New Guinea, and will require significant investment and management resources over the next 5 years. We believe it makes strategic sense for the Kili Teke exploration project to continue with dedicated focus, allowing further value to be unlocked for all stakeholders in Papua New Guinea.”

Definitive Agreement

KRL and HGEL have executed a definitive agreement for KRL to purchase Kili Teke by way of an asset acquisition. The acquisition is inclusive of the transfer of the Exploration Licence 2310 (“EL 2310”) and all associated assets and know-how, such as drill core, logs and data used to support the Mineral Resource.

The initial acquisition price payable by KRL is US$1 million, payable by two instalments of (i) US$500,000 on closing of the transaction and (ii) $500,000 on receipt of post-closing regulatory approvals (expected in late 2022 or early 2023).

Closing of the transaction is subject to customary closing conditions, including the approval of the TSX Venture Exchange (the “TSX-V”), PNG regulatory approval and registration of the sale agreement and all schedules to it, and KRL (at its discretion) raising financing of up to US$1 million. The parties are targeting closing of the transaction by May 31, 2022, at which point KRL will assume 100% ownership of the Project.

In future years, as the Project is advanced, KRL will move to complete a PEA. If KRL publishes a PEA (at KRL’s discretion), then the Company will pay US$3 million to HGEL within six months of publication and move to complete a Preliminary Feasibility Study or Feasibility Study.

If KRL completes and publishes such Preliminary Feasibility Study or Feasibility Study (at KRL’s discretion), then a further and final payment of US$4 million will be made to HGEL within six months of publication.

In addition to the cash payments, KRL will grant HGEL a 1.5% net smelter royalty upon the commencement of commercial production in the future.

KRL will also grant HGEL common share purchase warrants on closing of the Transaction exercisable for up to 9.9% of the Company’s issued share capital as of closing the Transaction, with each warrant being exercisable at an exercise price of C$0.28 per share, representing a 25% premium to KRL’s 30-day VWAP to April 5, 2022. HGEL has also been granted anti-dilutions rights with respect to future financings of KRL to maintain its equity ownership in KRL.

The definitive agreement also contains other terms and conditions as are customary for a transaction of this nature.

Strategic Rationale

The acquisition of Kili Teke will provide KRL with immediate ownership of a quality exploration project in a region well known to KRL management and stakeholders. The Company views the acquisition as transformational for KRL, given the clear development nature of Kili-Teke (beyond early-stage greenfield exploration).

Amongst other objectives, the Transaction:

- allows KRL to incorporate a sizeable Au-Cu resource into the Company’s asset base, potentially enabling a re-rating of KRL in due course;

- increases exposure to Cu as well as Au (in addition to KRL’s other exciting projects in Kainantu and May River);

- moves KRL’s overall portfolio further along the development curve, given Kili Teke’s advanced stage; and

- provides upside potential to KRL, with identified exploration targets and options to re-optimise the preliminary mining approach.

Project Overview

The Project comprises of EL 2310 and is located approximately 40km west-northwest of the Porgera Gold Mine, in the Koroba-Kopiago District of Hela Province, PNG. EL 2310 was granted to HGEL in May 2014 and has been renewed three times. The EL remains in good standing and is currently subject to a further renewal application at the end of the current term in May 2022. Pending renewal, the EL remains on foot with KRL entitled to continue to explore the project as is customary under PNG mining law.

An Inferred Mineral Resource of 237Mt @ 0.34% Cu (=0.8Mt Cu), 0.24g/t Au (=1.8Moz Au) and 168ppm Mo (=0.04Mt Mo), with an effective date of 30 June 2021 has been established by Harmony for the Project in accordance with the South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves (SAMREC, 2016 Edition) (www.samcode.co.za), which is recognised and accepted for the purposes of National Instrument 43-101, Standards of Disclosure for Mineral projects (“NI 43-101”). As part of the Transaction, KRL intends to file with applicable Canadian securities regulators and the TSX-V, within 45 days of this news release, an NI 43-101 compliant technical report in respect of the project.

In developing the Project, HGEL drilled 54 holes (for 36,325m), at an estimated cost of US$20 million. With multiple work streams ongoing in PNG, Harmony has taken a strategic decision to sell the Project to KRL as a credible junior explorer to allow exploration on the project to continue with a dedicated focus.

Regional and Local Geology

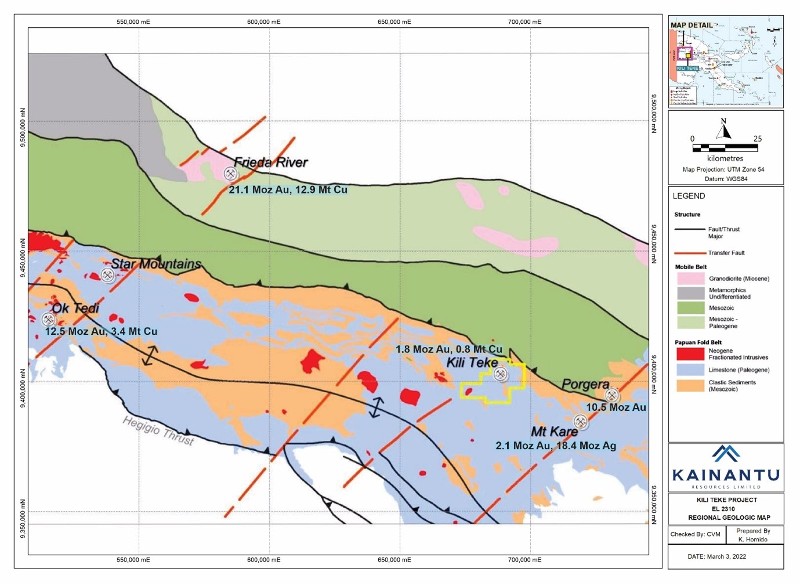

The Project lies within the Papuan Fold Belt, a mixed terrane of limestone and clastic sediments which have been strongly folded and thrusted during the evolution of the New Guinea magmatic island arc, on the northern margin of the Australian tectonic plate.

Numerous felsic and intermediate plutons, generated from the subducting Australian plate, are intruded into these sediments, and several are host to, or are associated with, large porphyry Au-Cu and epithermal Au deposits, respectively, including Ok Tedi (3.4Mt Cu, 12.5Moz Au*), Frieda River (12.9Mt Cu, 21.1Moz Au), Porgera (10.4Moz Au), and Mt Kare (2.1Moz Au). *Pre-production figures.

These world-class ore deposits are all located close to major deep-seated transfer faults which accommodate lateral slip between adjacent segments of the Australian plate, as it moves northwards. Kili Teke is located on the strike extension of a transfer fault and is highly prospective, as shown in Figure 1.

Figure 1: Kili Teke Regional Project Location

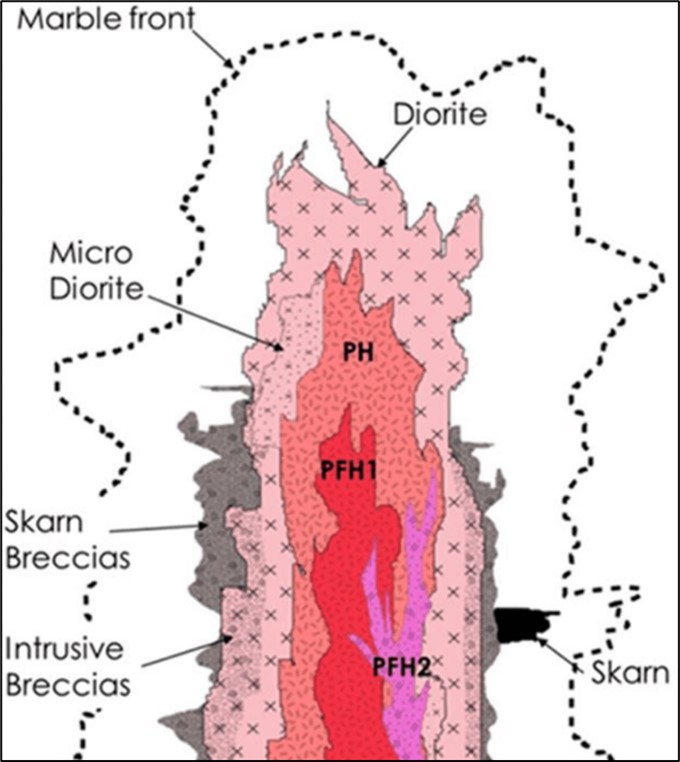

Kili Teke is hosted by a late Miocene (3.59±0.5Ma to 3.50±0.04Ma) multi-phase, intermediate-composition, intrusive complex (including diorite, microdiorite and hornblende porphyry lithologies), and associated breccias and skarns, as indicated in Figure 2. The latter occur both within (along structures), and on the margins of the intrusive complex, in limestone host rock.

Figure 2: Kili Teke Geology

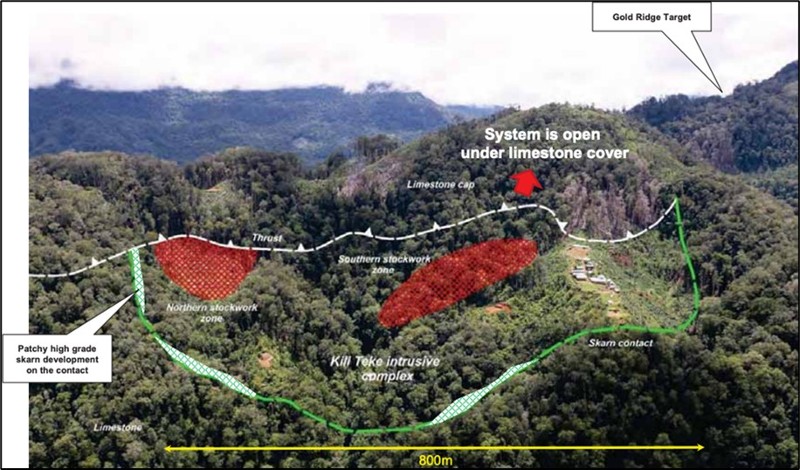

Mineralisation is exposed at surface. This is of particular interest to KRL, as it indicates the upper part of the deposit could be mined via an open pit, even though part of the deposit is covered by a limestone cap.

Studies indicate the strongest mineralisation is developed as disseminated and vein infill chalcopyrite, with lesser bornite, pyrite, gold and molybdenum, in two classic, porphyry-style stockworks: the Northern and Southern Stockwork Zones (NSZ and SSZ). Both of these high-grade zones are offset at depth by post-mineralisation faulting. A single drill intercept, from KTDD013, reported 319m@0.8% Cu & 0.57g/t Au, which demonstrates that this is a significant deposit, with high-grade potential.

Several zones of high-grade skarn mineralisation are also recognised, but the drill density is insufficient to confirm continuity at this stage and they have been excluded from the current Mineral Resource estimate. In due course, a priority for KRL will be further investigation of this skarn mineralisation.

The dominant alteration is an early potassic assemblage, composed of pervasive fine-grained biotite±K-feldspar±magnetite±sulphide (py+cp+mo). This is overprinted in turn by a secondary potassic event, restricted to breccia zones, pervasive phyllic alteration (sericite±quartz±sulphide), and late-stage argillic to intermediate argillic alteration (kaolinite±smectite clays), also restricted to major fault zones.

Importantly, the controls on high-grade mineralisation have not been defined. There remains residual upside potential to expand high-grade zones.

Potential Upside to the Mineral Resource Estimate

Since acquiring the Project in June 2014, HGEL has drilled 54 holes (for 36,325m), including 7 (for 3,683m) to test exploration targets. Using all currently available data, an Inferred Mineral Resource of 237Mt @ 0.34% Cu (=0.8Mt Cu), 0.24g/t Au (=1.8Moz Au) and 168ppm Mo (=0.04Mt Mo) has been defined for the Project.

Importantly, and as noted above, this defined Mineral Resource excludes all high-grade skarn intercepts because the drill density was considered insufficient to prove the continuity of these mineralised zones: see Figure 3, indicating the high-grade skarn area. These remain a viable exploration target, and an opportunity to increase the metal inventory significantly. (The inclusion of skarn mineralisation in a previously reported Mineral Resource potentially added 11% and 10% more Cu and Au metal, respectively, to that estimate.)

Figure 3: Kili Teke Project: High Grade Skarn Area

In addition to the deposit drill-out, in 2016 HGEL drill-tested 3 exploration targets close to Kili Teke. Of interest is the Ridge Gold Anomaly (RGA) target, located within 1km of the main resource, which has not been adequately explored as yet. This target was defined by surface geochemistry in stream sediments, and has subsequently been confirmed in soils and bedrock, via trench sampling (5m@0.37g/t Au & 0.77% Cu) and anomalous rock chips (up to 3.5g/t Au). The bedrock anomaly potentially extends beneath a limestone cap cover sequence, which means that RGA may be a much larger target than has been considered before. This will be another area of focus for KRL with the likelihood of further drilling at this target.

Concept Mining Study

A conceptual mining study has been completed for the Project (completed by Advisian, a consulting business of the WorleyParsons Group) to investigate the economic potential of an open pit and underground block cave development. This study was independently reviewed by AMC in 2017. KRL is keen to test the viability of an open pit operation. Compared to Harmony as a smaller operator, KRL will consider ways to re-optimise the Project with a focus on higher grades and lower through-puts, with an open-pit approach as one way to potentially optimise economic value.

To date, desk top studies by KRL suggest that an open pit operation is potentially viable (with a robust economic return) on the definition of more high-grade ore. In due course, this would require further infill drilling, focused initially on the two high-grade stockwork zones (NSZ and SSZ) and the marginal skarns; and any other features that can be targeted if the controls of mineralisation can be determined. KRL expects further investigation on the viability of these options are part of the intended work towards a PEA and Feasibility Study.

Infrastructure, Logistics and Community Relations

Local infrastructure to support a new mine at Kili Teke is favourable. The Hides gas power station, which supplies power to the Porgera Gold Mine, is 50km south of Kili Teke; and the largest sealed airstrip in PNG, at Komo, is 80km to the south (and there are dirt strips much closer, at Auwi and Tari). The government has announced funding to build sealed roads between the local towns of Komo, Tari, Korobo and Mendi, all of which would serve a future mine at Kili Teke.

KRL stakeholders have significant experience operating in the Hela District where the Project is located. Based on initial discussions with relevant community groups, KRL is confident it can develop a viable community programme at Kili Teke.

Next Steps

KRL will continue to work co-operatively with the management of HGEL to obtain all necessary regulatory approvals to close the acquisition and consolidate the Project into KRL.

Although KRL remains fully funded in order to complete the Transaction in the short term, closing of the Transaction is subject to KRL raising financing of up to US$1 million (or waiving this condition).

Qualified Person

The scientific and technical information disclosed in this release has been reviewed and approved by Graeme Fleming, B. App. Sc., MAIG, an independent “qualified person” as defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About KRL

Kainantu Resources ‘KRL’ is an Asia-Pacific focused gold mining company with three highly prospective gold-copper projects, KRL South, KRL North and the May River Project. All projects are located in premier mining regions in PNG.

Both KRL North and KRL South show potential to host high-grade epithermal and porphyry mineralisation, as seen elsewhere in the high-grade Kainantu Gold District. The May River project is in close proximity to the world-renowned Frieda River Copper-Gold Project, with historical drilling indicating the potential for significant copper-gold projects. KRL has a highly experienced board and management team with a proven track record of working together in the region; and an established in-country partner.

Enquiries:

Kainantu Resources

Matthew Salthouse, Chief Executive Officer (Tel: + 65 8318 8125)

Callum Jones, Corporate Development Co-ordinator (Tel: + 61 450 969 697)

Email: info@krl.com.sg

IR / Financial PR: Camarco

Gordon Poole / Charlotte Hollinshead / Tessa Gough-Allen

Tel: +44(0) 20 3757 4980

Financial PR North America: Jemini Capital

Kevin Shum / Jerry Huang Kevin@jeminicapital.com

Tel: +1 (212) 219-4680 | +1 (647) 725-3888 ext 702

For further information please visit https://kainanturesources.com/

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer and Forward-Looking Information Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s property. The data disclosed in this release relating to drilling results is historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data, and no representation or warranty, express or implied, is made by the Company, its affiliated companies, or any other person as to its fairness, accuracy, completeness, or correctness. This release contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: expectations regarding completion of the Acquisition and the terms thereof, including timing, the results of Preliminary Economic Assessments and Feasibility Studies, further exploration activities or development programs on the Project, receipt of necessary regulatory approvals and the formulation of plans for drill testing; the effect of the Acquisition on KRL and its portfolio; further growth of the Project; timing of the renewal of EL 2310; the ability of the Company to raise financing; the description and viability of the Project; the preparation and filing of a NI 43-101 Technical Report; and the ability of the Company to deliver on its strategic objectives and create shareholder value. These forward-looking statements and information reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include; success of the Company’s projects; prices for gold remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company’s projects; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive. The Company cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation); fluctuations in currency markets (such as the Canadian dollar versus the U.S. dollar); operational risks and hazards inherent with the business of mineral exploration; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices, including environmental, export and import laws and regulations; legal restrictions relating to mineral exploration; increased competition in the mining industry for equipment and qualified personnel; the availability of additional capital; title matters and the additional risks identified in our filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described, or intended. Investors are cautioned against undue reliance on forward-looking statements or information. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances.