Vancouver, B.C. – November 29, 2021 – Kainantu Resources Ltd. (TSX-V: KRL, FSE: 6J0) (“KRL” or the “Company”), the Asia-Pacific focused gold mining company, is pleased to report the filing of its third interim results for the period ending September 30, 2021, a copy of which is available for review on the Company’s website.

Key aspects to report over the period include:

- KRL South: continued progress during Q3:

- At the East Avaninofi Prospect:

- strong correlations of Au with Ag, Cu, Mo, and As; plus samples revealing elevated values of Bi, Te, and W (similar to the geochemistry of the nearby Bilimoia Mineral Field, renowned for its high-grade gold-copper intrusive style mineralization);

- high levels of Fe and S, as key indicators of high-grade Au potential; and

- increasing in intensity towards the N of the prospect, a NE trending Cu mineralization-controlling structure of at least 10m in width delineated.

- At the Yaora Ridge Prospect activities returned an Au sample of 4.37 g/t Au from surface, while further work has shown:

- strongly anomalous Cu and associated pathfinder elements; and

- lithologies, alteration and mineralization similar to the East Avaninofi Prospect; with the two prospects appearing to be linked;

- At the East Avaninofi Prospect:

- KRL North: analysis of initial mapping and sampling revealed:

- the strong likelihood of enhanced permeability extending from the mineral rich Bilimora Field (where successful high-grade miners already operate) into KRL North; and

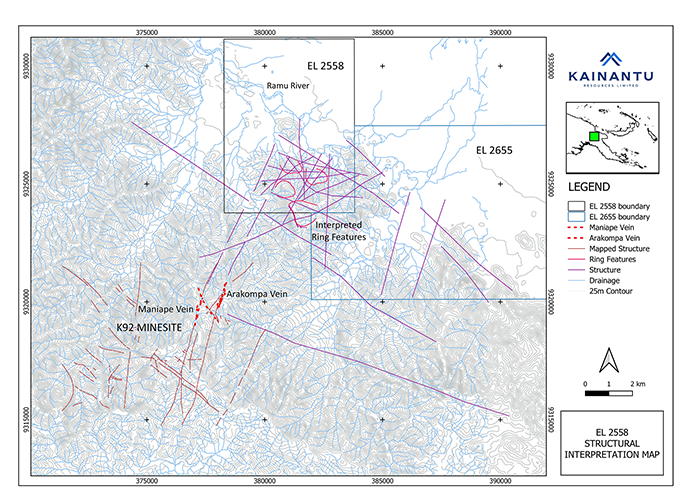

- an interpreted ring feature circa 1.5km in diameter situated on the triple junction of KRL North’s EL2558 and El2665 tenements; and K92 Mining’s tenement (see figure 1 below inclusive of interpreted ring features at KRL North).

Figure 1: KRL North – Interpreted Ring feature and regional setting

- KRL North and KRL South: an airborne geophysics survey programme is in the advanced planning stage to leverage off the positive results obtained from the successful exploration activities during 2021.

- May River Project: ongoing activities continue to further integrate the highly prospective Cu-Au project into KRL in coming months:

- KRL has given notice to Hardrock Limited to exercise its option to be granted 10% of that entity;

- the KRL Field Study has been completed (and is subject to a final peer review), validating the basis for investment. Initial samples from the Field Study include: up to 2.07ppm (2.07gt) Au, >100ppm (>100g/t) Ag and up to 1709ppm (0.17%) Cu from the Skiraisa Prospect;

- KRL granted Niuminco Limited an extension to December 31, 2021 to satisfy conditions under an SPA, to enable KRL to acquire the Iku Hill Prospect and surrounding area (but with KRL holding an ELA over the same area in the event of Niuminco being unable to resolve their outstanding issues with the PNG Mineral Resource Authority); and

- plans remain on track to develop a targeted exploration programme for the May River Project in 2022.

- Financial: prudent management of capital resources is ongoing:

- expenditure on exploration and evaluation activities for the 10 months to September 30, 2021 totalled $1.16 million (which has been capitalised), with additions of $0.40 million for the quarter;

- closing cash was $1.07 million with total cash outflows of $0.55 million during the quarter;

- a net loss for the 10 months of $1.11 million (inclusive of listing and equity compensation costs), the loss for the quarter was $0.16 million similar to the prior interim period; and

- given the Company’s transition to a calendar reporting cycle, the interim results are presented for a 10-month period on this occasion.

Matthew Salthouse, CEO of KRL, commented:

“KRL is pleased to provide this update for Q3 2021, with targeted and disciplined exploration ongoing at both KRL North and KRL South. Encouraging results support the Company’s decision to expedite a geophysics program to assist with definition of initial drill targets in 2022.

KRL has also advanced the May River Project during the quarter, giving notice to exercise its option over 10% of Hardrock, following substantial completion of a field study with results validating the high Cu-Au prospectivity of this area.”

Qualified Person

The scientific and technical information disclosed in this release has been reviewed and approved by Graeme Fleming, B. App. Sc., MAIG, an independent “qualified person” as defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About KRL

KRL is an Asia-Pacific focused gold mining company with two highly prospective gold projects, KRL South and KRL North, in a premier mining region, the high-grade Kainantu Gold District of PNG. Both of KRL’s projects show potential to host high-grade epithermal and porphyry mineralisation, as seen elsewhere in the district. KRL has a highly experienced board and management team with a proven track record of working together in the region; and an established in-country partner.

Enquiries:

Kainantu Resources

Matthew Salthouse, Chief Executive Officer (Tel: + 65 8318 8125)

Callum Jones, Corporate Development Co-ordinator (Tel: + 61 450 969 697)

Email: info@krl.com.sg

IR / Financial PR: Camarco

Gordon Poole / Nick Hennis

Tel: +44(0) 20 3757 4980

For further information please visit https://kainanturesources.com/

References in this release to $ are stated in USD.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release. Disclaimer and Forward-Looking Information This release contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: formulation of plans for drill testing; and the success related to any future exploration or development programs. These forward-looking statements and information reflect the Company’s current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include; success of the Company’s projects; prices for gold remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company’s projects; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive. The Company cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: fluctuations in gold prices; fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation); fluctuations in currency markets (such as the Canadian dollar versus the U.S. dollar); operational risks and hazards inherent with the business of mineral exploration; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices, including environmental, export and import laws and regulations; legal restrictions relating to mineral exploration; increased competition in the mining industry for equipment and qualified personnel; the availability of additional capital; title matters and the additional risks identified in our filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described, or intended. Investors are cautioned against undue reliance on forward-looking statements or information. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances.